inherited annuity tax calculator

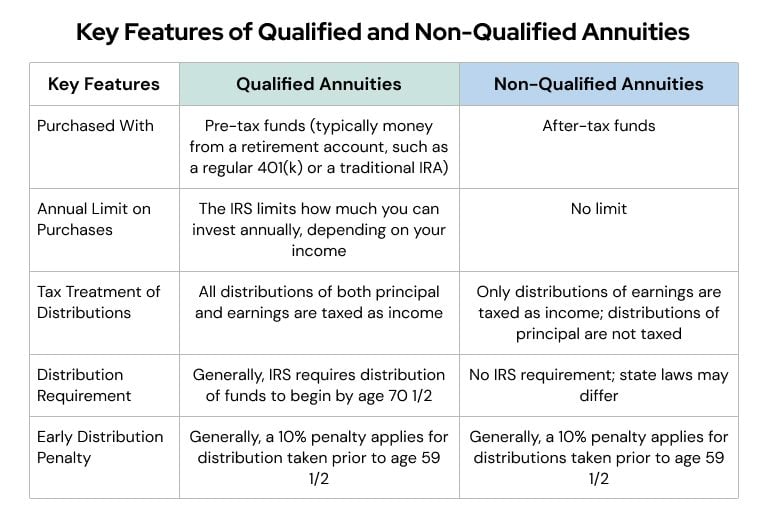

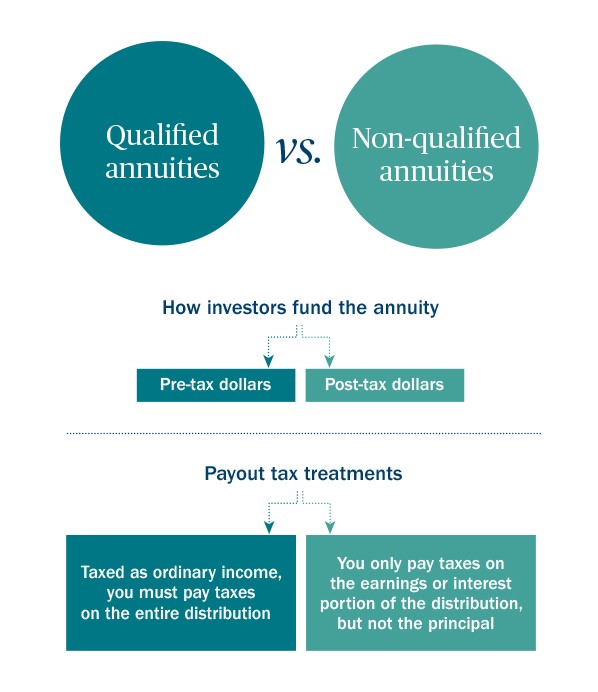

When you inherit an annuity the tax rules are similar to everything described above. You will pay taxes on the full withdrawal amount for qualified annuities.

Inherited Annuity Tax Guide For Beneficiaries

If youre the spouse of the.

. Tax Rules for Inherited Annuities. Taxes on an inherited IRA are due when the money is withdrawn from the account and taxed at your ordinary income tax rates. The amount excluded from estate tax 5490000 as of 2017.

These payments are not tax-free however. Tax Consequences of Inherited Annuities. The same options apply to spousal inherited annuities but with one additional option spousal continuance.

Surviving spouses can change the original contract. When an annuity payment is made 50 of each payment would be income taxable. Because your wife chose to cash in the annuity a portion of what she received will be income from the invested funds.

Ad Learn some startling facts about these often complex investment products. The Secure Act as â How is my RMD calculated. In exchange for this transaction the beneficiary will receive a one-time lump sum payment.

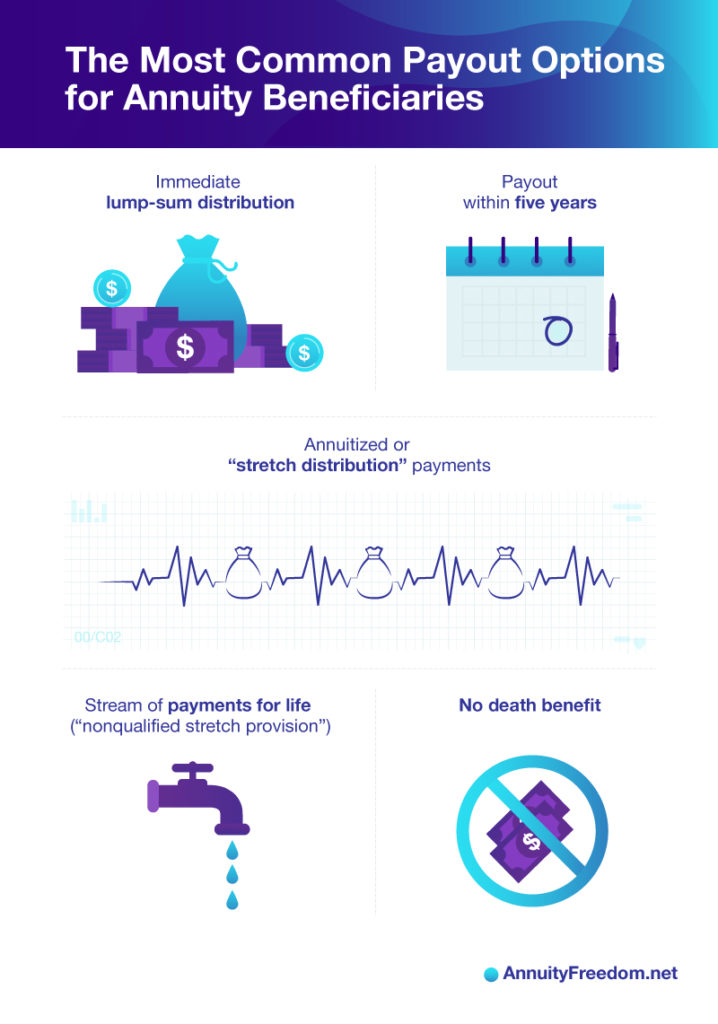

The beneficiarys relationship to the purchaser and the payout option thats selected can determine how an inherited annuity is. RMD applies to a traditional IRA or a qualified retirement plan. The money from an inherited annuity can be paid out as a single lump sum which becomes taxable in the year it is received.

Different tax consequences exist for spouse versus non-spouse beneficiaries. The proceeds of an inheritance are taxable. Taxes are typically due only on a traditional IRA.

Qualified annuity distributions are fully taxable. The earnings are taxable over the life of the payments. This calculator only applies to the first-generation beneficiary not a second-generation.

Please use our Annuity. Get this must read guide if you are considering investing in annuities. If the annuity owner still had ownership when he died the value of the annuity is included in his taxable estate.

People inheriting an annuity owe income tax on the difference between the principal paid into the annuity and the value of the annuity at the annuitants death. If a beneficiary opts to receive the money all at once he or she must pay taxes. Spousal continuance will allow the surviving spouse to.

If you have an inherited annuity and are interested in selling it CBC Settlement Funding can provide. Inherited Annuity Tax Calculator. Ad Learn More about How Annuities Work from Fidelity.

Payments can be spread. If the payout is over an annuitants lifetime and the annuitant outlives life expectancy all further payments. IRD is the income element of inherited property.

You will only pay income taxes on the earnings if its a non-qualified annuity. You should receive a Form 1099R Distributions from Pensions Annuities Retirement or Profit Sharing Plans IRAs Insurance Contracts etc from the payer of the lump. The annuities would not have an RMD if your father purchased them himself from an insurance company.

This calculator can estimate the annuity payout amount for a fixed payout length or estimate the length that an annuity can last if supplied a fixed payout amount. Inherited IRA RMD Calculator Inherited IRA beneficiary tool Calculate the required minimum distribution from an inherited IRA If you have inherited a retirement account generally you must. It sounds like she received the remaining balance so the 1099-R is probably marked as.

Its basically returning to you all of the money you paid them after tax plus interest. Ad Learn some startling facts about these often complex investment products. Taxes on an inherited annuity are usually dictated by your beneficiary status and how you receive payouts.

Get this must read guide if you are considering investing in annuities. Because of this only 148 of your 565 monthly payout will be subject to ordinary income tax. People inheriting an annuity owe income tax on the difference between the principal paid into the annuity and the value of the annuity at the annuitants.

Annuities are taxed as ordinary income when inherited. Total distribution in box. Your wife inherited her mothers annuity.

Ad Learn More about How Annuities Work from Fidelity.

Inherited Annuity Tax Guide For Beneficiaries

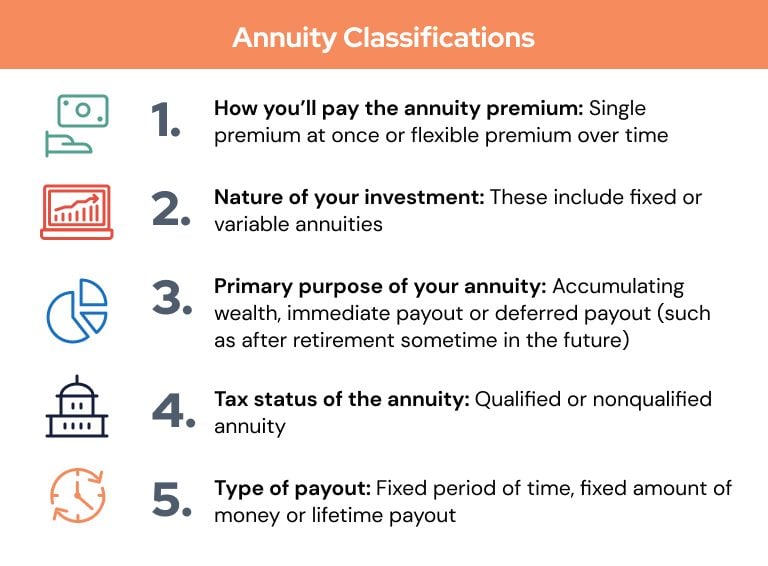

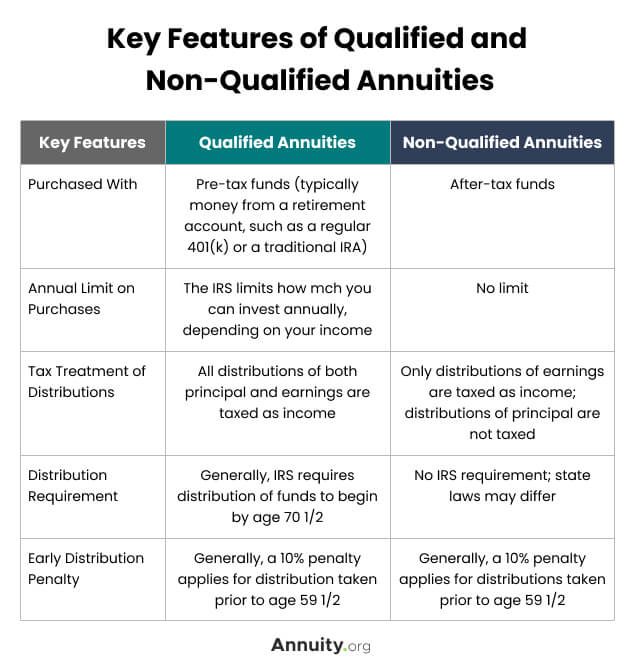

What S The Difference Between Qualified And Non Qualified Annuities

Annuity Exclusion Ratio What It Is And How It Works

Qualified Vs Non Qualified Annuities Taxes Rmd Retireguide

Annuity Beneficiaries Inheriting An Annuity After Death

Taxation Of Annuities Ameriprise Financial

Annuity Taxation How Various Annuities Are Taxed

Annuities Explained Information Annuity Basics

The Best Annuity Calculator 17 Retirement Planning Tools

Annuity Taxation How Various Annuities Are Taxed

How To Avoid Paying Taxes On An Inherited Annuity Smartasset

Annuity Exclusion Ratio What It Is And How It Works

How To Use Nonqualified Stretch To Stretch Out An Annuity S Tax And Income Pfwise Com

Qualified Vs Non Qualified Annuities Taxation And Distribution

Annuity Beneficiaries Inheriting An Annuity After Death

Offset Taxes On Inherited Iras With This Annuity Annuity Inherited Ira Ira